The 15-Second Trick For Guided Wealth Management

The 15-Second Trick For Guided Wealth Management

Blog Article

Getting The Guided Wealth Management To Work

Table of ContentsThe 9-Second Trick For Guided Wealth ManagementThe 3-Minute Rule for Guided Wealth ManagementGetting My Guided Wealth Management To WorkHow Guided Wealth Management can Save You Time, Stress, and Money.

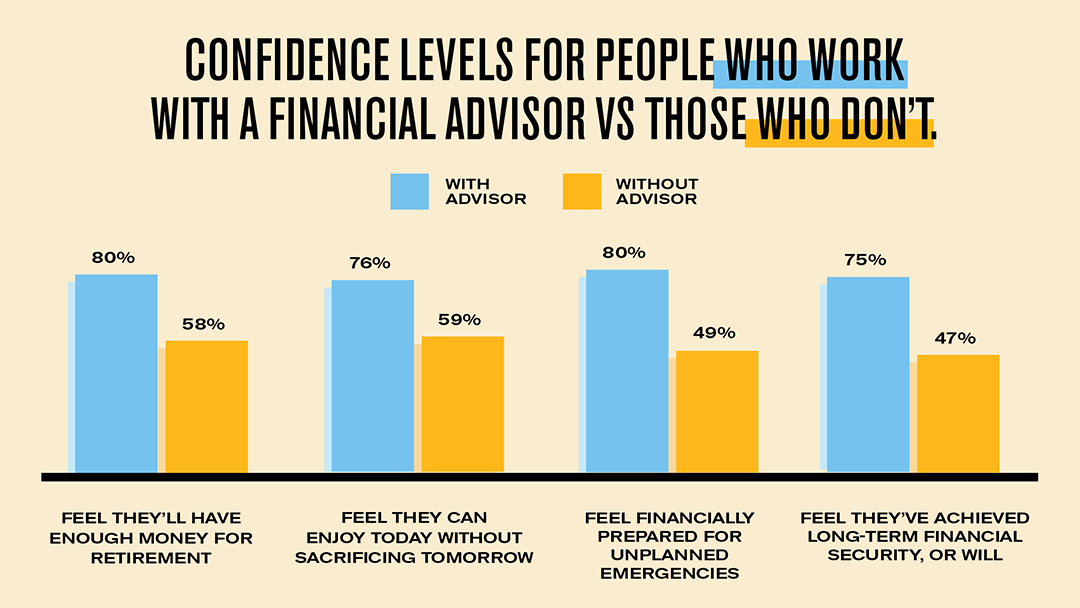

Retirement planning has actually never been more facility. With modifications in tax regulations and pension plan guideline, and hopefully a long retired life in advance, individuals approaching completion of their professions require to navigate a progressively challenging background to ensure their monetary needs will be met when they retire. Include in an unclear macroeconomic atmosphere, and the risk of not having a clear plan can have a severe influence on retired life high quality and way of living options.Looking for economic guidance is an excellent idea, as it can aid individuals to delight in a hassle-free retired life. Here are 5 means that people can benefit from involving with an expert economic advisor. Functioning with an advisor can help individuals to map out their retirement goals and ensure they have the best plan in position to satisfy those purposes.

"Estate tax is a complicated location," states Nobbs. "There are several means to manoeuvre via estate tax preparation as there are a variety of products that can help mitigate or reduce estate tax. This is just one of the numerous factors why it's important to assess your continuous economic setting." The tax you pay will depend on your individual conditions and rules can additionally alter.

Unknown Facts About Guided Wealth Management

"It can be extremely challenging to speak with your family members concerning this because as a society we don't like discussing cash and fatality," says Liston. "There's so much you can do around legacy, around gifting and around trust fund planning. I worry that so much of society doesn't know about that, let alone have access to it." If you're not using an advisor, just how do you manage your investments and just how do you understand you've picked the ideal items for you? While on the internet services make it simpler for clients to view their products and performance, having a consultant on hand can aid clients recognize the alternatives offered to them and reduce the admin worry of handling important source products, enabling them to concentrate on enjoying their retirement.

"Then you get involved in the globe of income tax return, estate preparation, gifting and wills. It's pretty difficult to do all of that on your own, which is why a professional can assist consumers to puncture the complexity." Retirement planning is not a one-off occasion, either. With the popularity of income drawdown, "investment does not stop at retirement, so you require an element of proficiency to understand how to obtain the right blend and the right balance in your investment remedies," claims Liston - https://hubpages.com/@guidedwealthm.

:max_bytes(150000):strip_icc()/financial_plan_final-e8e690fce7c7406fb4cc607e408681df.png)

A Biased View of Guided Wealth Management

Nobbs was able to assist one of his customers relocate cash into an array of tax-efficient items so that she could draw a revenue and wouldn't have to pay any kind of tax until she was about 88. "They live comfortably now and her partner had the ability to take layoff as an outcome," he says.

"Individuals can become truly worried concerning exactly how they will certainly money their retired life due to the fact that they do not understand what position they'll remain in, so it pays to have a conversation with a financial advisor," claims Nobbs. While conserving is one evident advantage, the worth of advice runs deeper. "It's all regarding giving individuals satisfaction, understanding their needs and assisting them live the lifestyle and the retired life they desire and to care for their family if anything should take place," states Liston.

Seeking financial suggestions may appear frustrating. In the UK, that is sustaining a growing suggestions gap just 11% of grownups evaluated claimed they 'd paid for economic advice in the previous two years, according to Lang Feline study.

What Does Guided Wealth Management Mean?

"The world of economic guidance in the UK is our heartland," states Liston. "If we return several years, the term 'the Man from the Pru' resonated up and down the streets of the UK. That heritage and the breadth of our suggestions indicate that we can offer consumers' requirements at any type of factor in their life time which helps build trust." M&G Wide range Guidance makes monetary suggestions more obtainable for more individuals.

They are experts in suggesting products from Prudential and other thoroughly chosen companions. This is referred to as a restricted guidance service.

It's not practically intending for the future either (super advice brisbane). A financial advisor can aid readjust your current circumstance in addition to preparing you and your family members for the years in advance. A monetary adviser can aid you with approaches to: Pay off your home funding quicker Conserve money and grow your assets Boost your very balance with tax-effective approaches Secure your revenue Develop a financial investment portfolio Provide your children a head start and help them secure their future Like any type of trip, when it involves your finances, preparation is the trick

Report this page